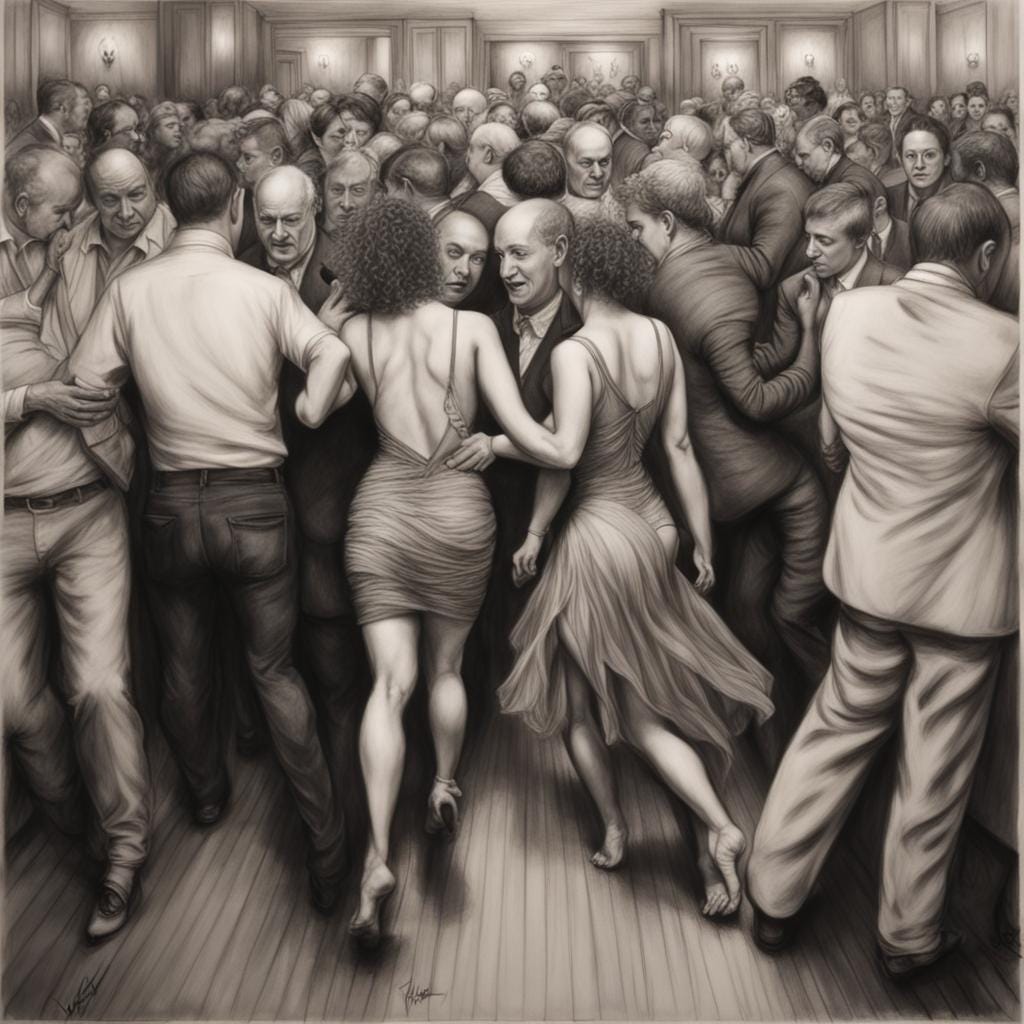

Treasury Quarterly Refunding decisions will be revealed at the end of this month. And ‘What a Diff’rence 90 Days Make’, as Dinah Washington never sang. The title of the original 1934 Mexican, version of her hit song was “Cuando vuelva a tu lado” (“When I Return to Your Side”), which is a good summary of Treasury yield performance over the three months. The 10-year closed at a yield high of 4.98% on 19th October, right before the last TQR. The same 10-year tenor, as at pixel time, stands at 4.03%. Phew! The lovers return and everyone is dancing again. Well, for now. Because what hasn’t changed is the fiscal outlook, or the crowded dance floor and the lack of clearly marked exits.

To be sure, while lovers may have forgiven each other, familiar arguments are not far away. CNBC reported last week: ‘For the period from October 2023 through December 2023, the budget deficit totaled just shy of $510 billion, following a shortfall of $129.4 billion in December alone.’ Half a trillion dollars! Sounds like another Dinah Washington title: ‘Trouble in Mind’. Then, two days ago (over the weekend) Congress revealed yet another short-term spending bill to avoid government shutdown till March. Of course, future coupon issuance remains, er, challenging. But those worries are just interesting syncopation for now. Let’s look instead at fundamental and growing incompatibility of dancers and dance hall itself.

Thanks for reading ExorbitantPrivilege! Subscribe for free to receive new posts and support my work.

A review of the documents submitted last Refunding cycle by the ‘Treasury Borrowing Advisory Committee’ (TBAC) shows they believed the main reason for the rise in longer yields was a rise in term premia. I am easily bored, and glaze over when people talk about bond ‘term premia’. Usually they really mean ‘duration risk’, which is itself another way of highlighting that a lot of people could make or lose a lot of money quickly, which often means interrupting the music. ‘Duration risk’ could become a financial stability issue.

Those who have been paying attention to ‘financial stability’ discussions will be aware of the unprecedented attention being given to the cash/futures basis trade. Given the price movements in bonds, the cheap long straddle offered by cash/futures basis in 2-year, 5-year, 10-year and Bond futures has probably proved a boon to the leveraged funds who traded this anomaly in Q4 2023. Overall, the strategy continues to attract attention. Conventional asset managers have seemingly concluded that liquidity value is price inelastic, and prefer futures whatever the cost. So, the net short open interest of leveraged funds remains at or close to all-time highs in all major US bond futures contracts.

The following charts illustrate the commitment to the cash/futures trade. The green line represents HF short futures positions and the yellow line asset manager long futures.

The cash/futures basis is a strong relationship, but could it become a problem? Lots of regulators, including those outside the US, are worried it may. There were a few bumps around year-end when US repo performed a jitterbug, but this mostly seemed to have affected those playing in a slightly different version using OIS swaps rather than futures.

In truth, the cash/futures basis is itself a reflection of a bigger issue. Namely, Treasury market access has not risen in line with the growing size of the total Treasury market. This is a consequence of conscious regulatory change and designed to improve financial stability! But there are now many more dancers in the dancehall, and the number of doors into and out of the hall has not increased. In fact, regulatory restriction means the number of exits has fallen. They are also a reason those seeking market access have move away from the traditional relationship with banks and broker-dealers to futures markets, causing the cash/futures basis to widen.

Reduced access is evident by comparing the total outstanding marketable Treasury debt with the average daily volume reported by FRBNY (and SIFMA). Over the fifteen years since the GFC, regulations and increasing outstanding debt have seen the ratio of daily turnover to total outstanding marketable debt fall from ~6% in 2009, (higher in 2008) to ~3% recently. The same portion of total Treasury bonds traded in 2009 now takes about twice as long to transact.

This lack of access capacity is a real concern, and may be disruptive. If sudden demand for liquidity by asset managers cannot be satisfied, futures may take the brunt, meaning leveraged funds in the cash/futures basis may be subject to sudden margin calls, and loss. If someone trips on a crowded dance floor, a lot of others may fall over.

Are there signs that a clumsy move may be near at hand? Not really. But price volatility is probably the biggest long-term concern for asset managers in Treasury market. The Treasury market is the world’s ‘Risk-free rate’, which means structural increase in volatility is a serious matter for all investments, not just Treasury bonds. That volatility seems to have increased since 2020.

Obviously, the last quarter saw ‘nice’ volatility, with prices rising fast. Although the holders of bonds would have been pleased, the move nevertheless reflects a rising institutional uncertainty about Treasuries. Realised volatility has structurally increased from the very low levels of 2012-2020. The chart below shows price volatility both for a generic 4% coupon Treasury bond and a continuously roll-adjusted TNote futures price. There is some discrepancy between the two series, but the result is similar. Both series show peaks in March 2020 which was the last time the cash/futures basis caused real problems.

Charles ‘Chuck’ Prince of Citibank, in 2007, before regulations curtailed the capacity of broker dealers, famously said: “As long as the music is playing, you’ve got to get up and dance.” Seems the US authorities are taking the same hope-for-the-best attitude. Let’s hope for the dancers opt for the Waltz and not the Quickstep.

Thanks for reading ExorbitantPrivilege! Subscribe for free to receive new posts and support my work.