The Framework

A novel strategy powered by Information Theory

Robust analysis and valuation metrics to navigate the constantly changing investment universe.

Challenge

Inefficiencies in today's markets are fleeting and nuanced. Traditional strategies struggle to capture them consistently.

Opportunity

Information Theory offers a lens to quantify uncertainty and exploit subtle price discrepancies.

Solution

A revolutionary strategy that leverages information uncertainty for superior alpha generation across a range of portfolios and asset classes.

Traditional Stat Arb Limitations

Our strategy overcomes limitations of correlation-based approaches, capturing more nuanced market inefficiencies.

Information Advantage

Our data-driven, information-theoretic approach provides a unique edge in today's complex markets.

Differentiated Alpha Generation

We unlock alpha opportunities overlooked by traditional quant strategies.

Automated Analysis & Execution

Our automated trading system aims to download market data, analyse and execute trades automatically & rapidly to capture fleeting alpha opportunities. APIs into data source and into trading platforms.

Real Time Monitoring

Continuous monitoring of information content ensures the strategy adapts to evolving market dynamics.

Scalability & Robustness

The framework is designed for scalability and adaptability across diverse asset classes and across diverse portfolios.

Axioms

- Market uncertainty is synonymous with information.

- Uncertainty is always ≥ 0

- Uncertainty is bounded ( <∞ ) through information fungibility (dollars/monetary value).

Hypotheses

- The uncertainty of a financial asset is encoded in price variance which is a persistent feature (Natural Gas

is inherently more idiosyncratically volatile and uncertain than S&P500). - Price variance is convertible into standard units (for instance, dollars).

- The product of shared uncertainty of each member of a portfolio constitutes the variance of a portfolio,

also equal to the information needed to explain the variance of that portfolio. - Mutual uncertainty is reduced uncertainty; a portfolio can be accurately described by fewer factors than

the number of portfolio constituents. - Mutual uncertainty is accompanied by inexplicable noise (weather, local liquidity, local supply/demand).

Noise is constant and variable and bounded.

From Entropy to Actionable Insights

Demystifying Information Theory

Information Theory is the foundation of reliable communication transmission and decoding.

By identifying uncertainty (entropy) in a message the Theory corrects errors and omissions of any message across any medium, subject to bandwidth constraints. Uncertainty (entropy) in a message is the information of the message.

Framework Entropy

The measure of uncertainty within a system, such as market price movements within or between asset classes.

Mutual Entropy

Quantifies the shared information between two assets, revealing shared relationships.

Conditional Entropy

Explains the remaining uncertainty after accounting for one asset, identifying exploitable price imbalances

Service levels

- Asset management partnership

- Ongoing bespoke portfolio analysis partnership

- Updates on specific portfolio

- Updates on our Base Universe portfolio

* Updates delivered via secure website, API or email

BEYOND CORRELATION

Unveiling Hidden Connections

Mutual Information vs. Correlation

Beyond simplistic correlation, capturing non-linear and dynamic relationships.

Exploiting Conditional Entropy

Categorise assets by entropy for higher accuracy.

Dynamic Value Selection

The model continuously adapts, identifying new trading opportunities based on evolving market information content.

Entropy-Weighted Portfolio Construction

Allocate capital based on information content, maximizing alpha per unit risk

Edge/Odds

Empirical high win ratio is paired with favourable odds advantage to allocate risk. This minimises risk of ‘ruin’.

Adaptive Trade Sizing/Hedging

Employ entropy-informed position sizing to capitalize on high-conviction trades and navigate periods of increased market uncertainty.

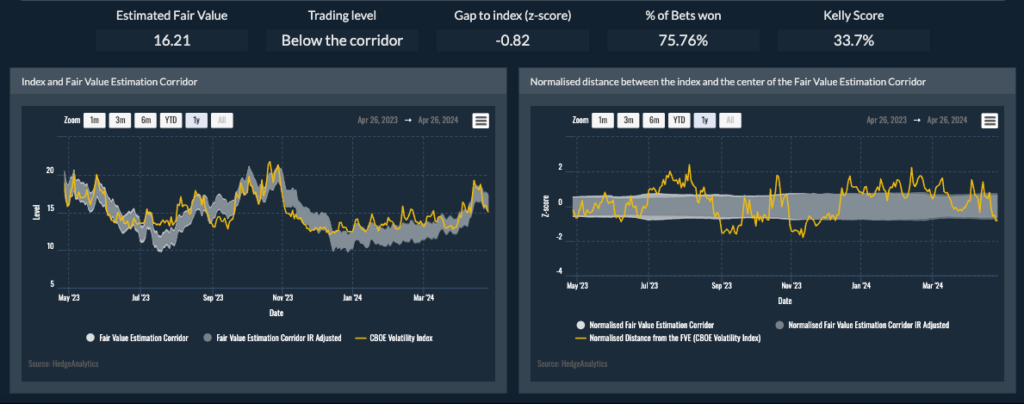

Quantifying the edge

Back Testing & Validation

Rigorous Testing

Extensive back testing across a wide range or portfolios, market conditions and monetary ‘eras’ validates the strategy's effectiveness and risk profile.

Sharp Ratio Supremacy

Our strategy delivers superior Sharpe ratios compared to traditional Stat Arb approaches and compared to long-only portfolios.

Efficient Capital

‘Days in market’ at approximately 37% of days is highly efficient use of capital.

Drawdown Minimization

Built-in risk management mechanisms ensure controlled drawdowns and consistent alpha generation across the portfolio.

Unleash the power of data-driven investing.

Leverage our robust analytics, accurate valuations, and systematic strategies to drive your investment success.